On February 9, 2011, the FCC (News - Alert) released a Notice of Proposed Rulemaking (“NPRM”) and Further Notice of Proposed Rulemaking seeking comment on numerous proposed changes to “fundamentally modernize” the USF (Universal Service Fund) and another subsidy program called the “intercarrier compensation system.”

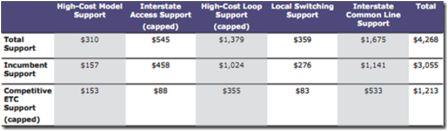

The USF “High Cost Fund” is a multibillion dollar annual subsidy created in 1996. The High Cost Fund is a tangled web of caps, cost studies, and complex rules. The USF High Cost Fund quietly transfers a significant amount of money - $4.8 billion every year - from urban telephone customers to rural telephone customers. There is a “quiet transfer” because the typical customer paying the USF fee and the typical customer receiving the fee have no clue that the USF fee is supporting the telephone service for rural customers. Other USF fees fund geo-neutral services: the $1.2 billion Low Income fund and $2.7 billion Schools & Libraries E-rate fund. A grand total of $8.7 billion per year is collected and distributed under the plan. To put this amount in perspective, two years of USF collections equals 12.5% of the total amount of $134 billion Recovery Act stimulus funds received during 2009 and 2010.

.jpg)

The primary purpose for the federal government’s creating USF in 1996 was to ensure that rural America received the same telephone service “and information services” as urban America. Rural customers, no matter how far “off the grid,” are entitled (one of our “entitlements”) to a) telephone service – known as “universal service” and b) prices for the telephone service in the ball park (“reasonably comparable”) to what customers in urban areas pay.

The USF mechanisms for determining which company receives how much of this subsidy is exceedingly complex. For those of you who wonder about the complexity, take a quick read of the 289 page FCC USF NPRM. After reading the NPRM, try to explain the USF payment and contribution concepts current or proposed to an intelligent friend. It is difficult for the average college educated person to understand how USF is charged and who receives the payments.

This complex USF fee/tax is costly to users. The fee is now 15.5% of the interstate revenue. The FCC has been under pressure for years to reform USF to remove the complexity and perceived “unfairness.” The FCC pointed out subsidy payment unfairness by illustrating it on a per line basis and suggested a cap on a “per line” basis:

“But some companies with fewer than 500 lines have received USF support … ranging between $8,000 to over $23,000 per year per line, which translates into subsidies for local phone service ranging from roughly $700 to nearly $2,000 per line per month.”

The FCC is also concerned that carriers are taking unfair advantage of USF and have no incentive to run an efficient operation:

“We are concerned that, absent some limit in federal support, carriers lack adequate incentives to curb costs.”

One of the primary proposals is to remove the complexity from the USF rules to make the subsidy payments more transparent which will assure that companies needing USF subsidies receive the payments and those companies taking unfair advantage of the USF program stop receiving the subsidies. The other reason for reforming USF is to combine funds into a new Connect America Fund which will subsidize capital expenses and operating expenses to deploy broadband for rural America.

There are three problems with USF: 1) calculating USF is complex, 2) determining who receives what is complex, and 3) it is not always achieving its purpose of being used for new capital expenditures (like fiber or wireless construction in rural areas). One concept to solve problem #1 on the payment and collection side could help eliminate the complexity for the paying customers and companies:

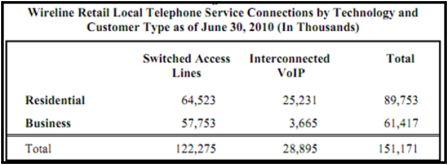

Charge Customers A Simple Flat Rate USF Fee Similar to the 911 Fee. Currently the USF “fee” – really a tax – is 15.5%. It is on interstate revenues only. For flat rate service where all calls in the US are included, as is often offered with VoIP service for example, a default rate of 64.9% of VoIP revenue is used to allocate the interstate portion of the flat rate service. It is difficult for customers – the ones paying the $8.7 billion fee - to calculate how the 15.5% is charged. It would be much simpler to charge a flat fee per access line, Interconnected VoIP service, and mobile phone. As of 2010, there were 151,171,000 wireline “service connections” consisting of 122,275,000 “access lines” and 28,895,000 “Interconnected VoIP.” Also, cellular CMRS companies, which often benefit from the USF fees, could collect the fee from their 293 million customers.

Fundamentally, USF is a tax that is used to support certain portions of the population for telephone and now broadband service. There is no reason that the tax needs to be so complicated to calculate and so hidden from the American consumer. The consumer’s bill should just show a flat rate USF fee. A modest fee of $2.00 per month for wired “service connections” and a cell phone fee of $1.40 per month could generate $8.55 billion annually replacing the USF collections of $8.7 billion.

There may be some gamesmanship here as an “access line” is not easy to define these days – for example, how many access lines are delivered with DS1 or DS3? But 911 fees have been charged on a per line basis for many years and the 911 model could be used.

Comments on Section XV of the USF NPRM were filed on April 1, 2011 with reply comments due on April 18, 2011. The FCC is holding a day long USF workshop on April 6th. Comments on the other sections are due on April 18, 2011, and reply comments on May 23, 2011.

*The telephone above was used for the railroad in the Mojave Desert in Kelso, California.

Barlow Keener, attorney with Keener Law Group, writes the Law & Regulation column for TMCnet. To read more of Barlow's articles, please visit his columnist page..

Edited by Rich Steeves

Internet Telephony Magazine

Click here to read latest issue

Internet Telephony Magazine

Click here to read latest issue CUSTOMER

CUSTOMER  Cloud Computing Magazine

Click here to read latest issue

Cloud Computing Magazine

Click here to read latest issue IoT EVOLUTION MAGAZINE

IoT EVOLUTION MAGAZINE