The Future Looks Bright for Revenue Assurance

March 21, 2017

By Alicia Young

Web Editor

Revenue leakage is a growing problem facing communication service providers (CSPs). In fact, it’s almost impossible to discuss any kind of fraudulent activity without mentioning revenue leakage as one of the consequences.

According to the telecommunications industry organization GSMA (News - Alert), an average-sized mobile network of 16 million subscribers could experience revenue leakage in excess of $4 million per year from SMS-related fraud alone. Meanwhile, Dialogue believes that service providers could save as much as $15 billion in additional revenue if they were to take action against grey routes. That’s a lot of money saved by simply addressing two problems. Imagine how much money would be saved if actions were taken against all sources of revenue leakage.

But, what kind of action? That’s where revenue assurance solutions come into play. According to Gartner, “Revenue assurance is the application of a process or software solution that enables a communications service provider (CSP (News - Alert)) to accurately capture revenue for all services rendered. Instead of correcting errors after they occur, or not detecting and correcting them at all, revenue assurance enables the CSP to examine and plug dozens of actual or potential leakage points throughout the network and customer-facing systems, and to correct data before it reaches the billing system.”

However, when I talked to Chip Stevens, iconectiv (News - Alert)'s director of product management, a few weeks ago, he mentioned that revenue assurance needs to become a bigger part of company operations for CSPs. There need to be dedicated departments that acknowledge the existence of fraud and lay in wait to deal with any problems that may occur.

Well, according to fraud and revenue leakage research conducted for Neural Technologies, it turns out that companies are finally jumping on the revenue assurance bandwagon. Jeremy Cowan, writing for Vanilla Plus on the topic, pointed out that revenue assurance used to be handled by CEOs. Now, he writes, “In this survey 21 percent of respondents were heads of the Fraud Department, 15 percent were described as Team Leaders, 12 percent were heads of the Revenue Assurance Department, 10 percent were Fraud Analysts (there was no breakdown of internal or third party staff), and 8 percent were Revenue Assurance Analysts. CEOs, CFOs, CIOs, and CTOs each made up 1 percent, and the remainder (30 percent) held other job titles.”

Although this may not be perfect—as there’s no one observed title for revenue assurance yet—it seems to be a step in the right direction. Departments that deal solely with revenue assurance are going to be far more effective than a CEO that has a million other things on his/her plate.

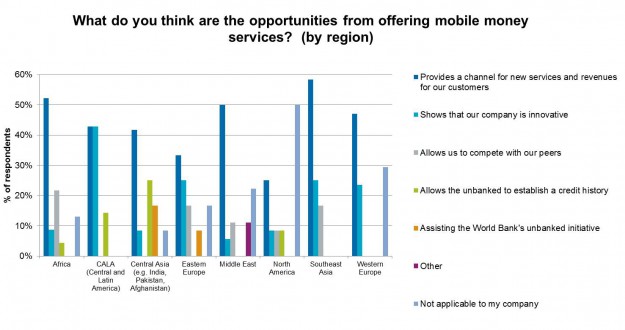

Allowing fraud to be handled by dedicated teams also sets the company up to explore new offerings. According to the survey, many organizations feel that there is a lot to be gained by offering mobile money services.

Image via VanillaPlus

Image via VanillaPlus

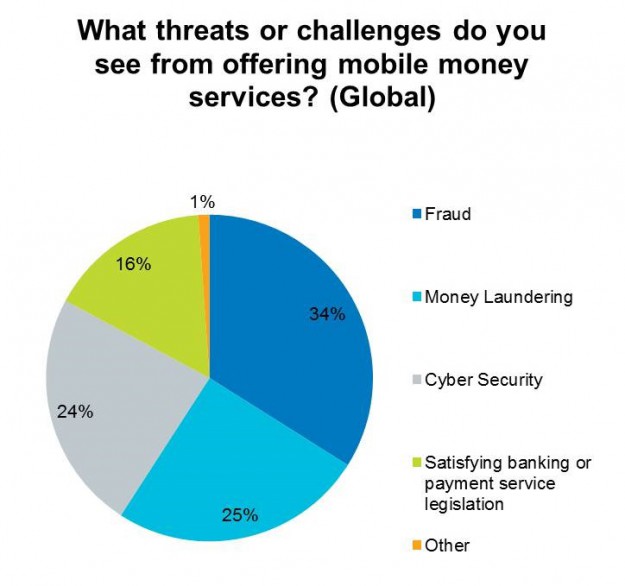

Unfortunately, these same organizations feel that there were also several risks that went along with offering mobile money services.

Image via VanillaPlus

Image via VanillaPlus

The biggest factor that instills this fear is fraud at 34 percent. Money laundering and cybersecurity also make organizations anxious about implementing mobile money services. These fears often keep companies from offering these services, which ultimately makes them fall behind competitors. Either way, money is lost, whether it’s through revenue leakage from fraud or missed opportunities.

However, we may be seeing a change in attitude now that there are more dedicated departments to revenue assurance. Between these dedicated teams and the various revenue assurance solutions available, companies should be able to detect and prevent any revenue leakage that may be occurring, allowing them to offer as many services as they want without worry. This is good for CSPs as well as customers who want to get the most out of their providers’ offerings.

Edited by Stefania Viscusi

Article comments powered by

Internet Telephony Magazine

Click here to read latest issue

Internet Telephony Magazine

Click here to read latest issue CUSTOMER

CUSTOMER  Cloud Computing Magazine

Click here to read latest issue

Cloud Computing Magazine

Click here to read latest issue IoT EVOLUTION MAGAZINE

IoT EVOLUTION MAGAZINE