Accenture Finds $470 Billion in Insurance Premiums Up for Grabs

August 04, 2015

By Peter Bernstein

Senior Editor

Traditional insurers have fallen behind technologically. Indeed, in a true irony for companies that are all about assessing risks, the incumbent insurers have put themselves at risk of not having sustainable competitive advantage, as “disruptors” have targeted their business as one ready to be taken.

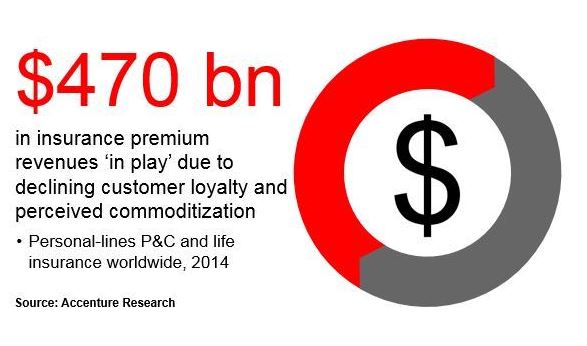

Just how big this risk could be has emerged in a new Accenture (News  - Alert) Strategy report, Capturing the Insurance Customer of Tomorrow. How big is big? The word “extremely” applies here.

- Alert) Strategy report, Capturing the Insurance Customer of Tomorrow. How big is big? The word “extremely” applies here.

Based on Accenture’s Global Consumer Pulse (News - Alert) Research, which included more than 13,000 P&C and life insurance customers in 33 countries, it is estimated that as much as $470 billion in life insurance and property & casualty insurance premiums will be up for grabs globally. Accenture found in its survey work that the drivers of this problem are declining customer loyalty and the perceived commoditization of products. “Leading insurers realize the need to offer a broader range of innovative products and services and create a differentiated customer experience, which will likely require partnering with nontraditional players”

If you are one of the old line insurers this survey highlights things you really be worrying about. The list is rather long and discouraging:

- Less than one-third (29 percent) of insurance customers are satisfied with their current providers.

- The number of customers who believe that most insurance carriers are the same in terms of their products and services jumped 50 percent in the last year, to 21 percent in this year’s survey from 14 percent in a similar survey last year.

- 16 percent of respondents said they would definitely buy more products from their current insurance provider.

- 27 percent have a high estimation of their insurance providers’ trustworthiness,

- 23 percent said they would consider buying insurance from online service providers, including technology giants.

“Today’s insurance customer is more empowered, more social and has higher expectations of his/her providers,” said John Cusano, senior managing director of Accenture’s global Insurance practice. “The study data indicates insurers are not keeping up with rising customer expectations, leading to increased customer dissatisfaction with insurance providers. This has created a ‘switching economy,’ which threatens traditional insurers by giving the advantage to companies most successful at exploiting digital technologies.”

But wait there is more!

Some trends that fell out of the survey are food for thought as well.

- 47 percent of the survey respondents said they want more online interactions with their insurers.

- 49 percent of P&C consumers said they purchased a policy online in the past six months, with 41 percent using a mobile phone to make the purchase. The percentages are even higher for customers in emerging markets, with 57 percent of P&C consumers purchasing a policy online, and 69 percent of those using a mobile phone to make that purchase.

A kicker in the findings is that even as consumers are turning to online capabilities to procure policies, only 15 percent said they are satisfied with their insurers’ digital experience.

“Leading insurers realize the need to offer a broader range of innovative products and services and create a differentiated customer experience, which will likely require partnering with nontraditional players,” added Jean-Francois Gasc, managing director, Insurance, Accenture Strategy, Europe, Africa and Latin America. “As a result, traditional insurance providers face a stark choice: embrace digital and customer-centricity, or become a highly efficient manufacturing utility, leveraging capital and digital technologies to provide low-cost insurance product manufacturing and servicing. Those who do neither are likely to lose out in this switching economy.”

The survey result that said customers will look to large technology companies is closer to happening than you think. Google (News  - Alert) for one already is like the proverbial camel with the nose under the tent that eventually is all the way in. The launch of Google Compare Auto Insurance is surely a harbinger of things to come. And the automotive industry is an apple that Apple (News

- Alert) for one already is like the proverbial camel with the nose under the tent that eventually is all the way in. The launch of Google Compare Auto Insurance is surely a harbinger of things to come. And the automotive industry is an apple that Apple (News  - Alert) would like to make Apple to the core.

- Alert) would like to make Apple to the core.

Make no mistake that since these and other tech companies view cars as “platforms” for gathering and using information, more than one camel has their nose not just under the tent but with the full head coming soon.

Edited by Dominick Sorrentino

|

Article comments powered by

|

Internet Telephony Magazine

Click here to read latest issue

Internet Telephony Magazine

Click here to read latest issue CUSTOMER

CUSTOMER  Cloud Computing Magazine

Click here to read latest issue

Cloud Computing Magazine

Click here to read latest issue IoT EVOLUTION MAGAZINE

IoT EVOLUTION MAGAZINE