TMCnet News

The Highs and Lows of Cannabis Sales TaxWolters Kluwer Tax & Accounting: This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20181217005849/en/

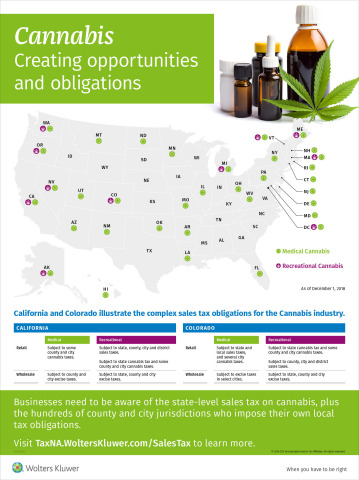

Cannabis Sales Tax Obligations (Graphic: Business Wire) What: The legalization of cannabis in one form or another in individual states across the U.S. has evolved throughout 2018 an is expected to continue in 2019. As a closely regulated industry, cannabis retailers, distributors, wholesalers and growers have broad sales and excise tax obligations. Why: Cannabis retailers must understand the intricate sales tax requirements at the state and local levels to remain compliant, including the collection of excise tax and cultivation tax from cultivators or manufacturers, as well as file cannabis and sales tax returns in the appropriate timeframe and channels. Sales tax compliance will help businesses avoid audits, criminal prosecution and secure financial funding. Over 30 states have approved the sale of cannabis for medical use which are subject to a diverse set of sales tax compliance at the county and city level, and over 10 states have legalized the sale of recreational cannabis which carries a variety of cannabis and excise taxes at the county, district, city, and state levels. Contact: To arrange an interview with Mark Friedlich, Esq., CPA, Senior Principal, Tax and Accounting Consulting, Tax & Accounting North America, a leading practitioner of indirect taxation in the U.S. and abroad, please contact:

View source version on businesswire.com: https://www.businesswire.com/news/home/20181217005849/en/ |