TMCnet News

Credit Card Companies' Support for Small Businesses During COVID-19 Not Enough to Drive Customer Satisfaction, J.D. Power FindsSignificant efforts by credit card issuers to support their small business customers with late payment forgiveness, waived charges and community initiatives during the COVID-19 pandemic have failed to drive strong customer satisfaction, loyalty or brand advocacy. According to the J.D. Power 2020 U.S. Small Business Credit Card Satisfaction Study,SM released today, small business customer satisfaction declines sharply from 2019, regardless of whether those business owners were aware of relief efforts put in place by their card issuers. This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20201124005044/en/

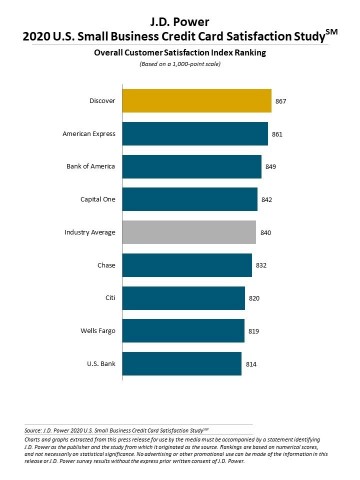

J.D. Power 2020 U.S. Small Business Credit Card Satisfaction Study (Graphic: Business Wire) "Business credit card customers are broadly aware and appreciative of the relief efforts card issuers have put in place during the pandemic, but it hasn't been enough to outweigh the tough times and strain these businesses are feeling," said John Cabell, director of wealth and lending intelligence at J.D. Power. "This is particularly true among the smallest small businesses. Strategies that are resonating for issuers and small business customers during this challenging time are those that focus on increased communication-particularly through digital channels-in which issuers offer advice and guidance, community support and late payment forgiveness." Following are some key findings of the 2020 study:

Study Ranking Discover ranks highest in customer satisfaction among national issuers for a second consecutive year, with a score of 867. American Express (News - Alert) (861) ranks second and Bank of America (849) ranks third. The J.D. Power 2020 U.S. Small Business Credit Card Satisfaction Study, now in its second year, measures customer satisfaction with the largest small business credit card issuers in the U.S. by examining six factors (in alphabetical order): benefits and services; channel activities; credit card management; credit card terms; key moments; and rewards. The 2020 U.S. Small Business Credit Card Satisfaction Study includes responses from 2,962 small business credit card customers and was fielded in July-August 2020. For more information about the U.S. Small Business Credit Card Satisfaction Study, visit https://www.jdpower.com/business/resource/us-small-business-credit-card-study. To view the online press release, please visit http://www.jdpower.com/pr-id/2020161. J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies. J.D. Power is headquartered in Troy, Mich., and has offices in North America, Europe and Asia Pacific. To learn more about the company's business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com. About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

View source version on businesswire.com: https://www.businesswire.com/news/home/20201124005044/en/ |