(Editor’s Note: Jonathan S. Marashlian is the head of the regulatory practice of Helein & Marashlian (News - Alert), LLC, The CommLaw Group. He counsels clients engaged in the IP-enabled communications industry in all aspects of state and federal regulatory and telecommunications tax compliance matters. This is part one of a four-part series on Voice over Internet protocol, or “VoIP” provider compliance with taxation and regulatory fees. This installment focuses on the basics of VoIP service.)

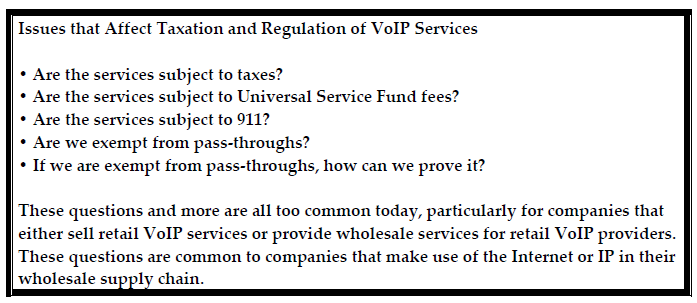

Words you have heard about your business probably include telecommunications, telecommunications services, VoIP telephony, interconnected VoIP (“I-VoIP”) and IP telephony, to name a few. In general, these are all “communications”; however, depending on whether you are before the FCC (News - Alert), a state utility commission, a taxing authority, a 911 administrator or local government, the precise words have special meanings and a variety of distinct legal consequences.

It is not just legal consequences with regard to government agencies that matter — legal consequences with suppliers and customers are important, too. In addition, participants in the communications industry can have different understandings about what constitutes “telecommunications” — which could affect whether taxes or fees are imposed or there is a tax exemption (see below).

Plain and simple, there is a great deal of confusion out there and, unfortunately, there are few simple, clear and generalized answers. The legal, regulatory and tax landscape applicable to VoIP communications services is highly uncertain, conflicted and changing rapidly. One thing is for certain, however, and that one certainty is the uncertainty.

At the end of the day, regardless of the questionable nature of a particular governmental agency’s legal authority to impose tax or regulatory burdens on certain providers, what all too many companies are finding out is that what really matters is not what the law says – it is what their suppliers tell them they must do.

Background

The history of figuring out the appropriate framework to govern, regulate and tax IP-based communications began in 1995, when America's Carriers Telecommunication Association (“ACTA”), an association of long distance resellers, became so concerned about the unfair competitive advantages a new breed of software-based “IP Telephony” providers might gain over its members simply by virtue of being unregulated, that ACTA filed a petition asking the FCC either to (1) impose the existing regulatory obligations on VoIP as were being applied to functionally equivalent traditional telephone services or (2) alleviate the traditional carriers from those burdens. The ACTA Petition sought regulatory parity, but evoked strong global opposition out of fears that parity would impede technological advancement. One specific consequence was that the ACTA Petition spawned the VON Coalition, the first Internet telephony association. The stir created by the very public bickering of ACTA and the VON Coalition ultimately led Congress to become involved.

In 1998, in a report to Congress requested by the then-powerful Sen. Ted Stevens, R-Alaska the FCC stated its position on regulating various types of IP-based communications services. Proper emphasis must be placed on the term “position.” It was in this report — aptly referred to as the “Stevens Report” — that the FCC first employed the terms phone-to-phone, computer-to-computer and computer-to-phone.

But the Stevens Report was not the law, nor was it a statement of actual FCC regulations — at most, it was a statement of the FCC’s views on the topic. In other words, it was the FCC’s position on VoIP in a hypothetical world in which the FCC regulated VoIP. Notably, the FCC never did anything to formally memorialize its views in actual regulations, and it never did rule on ACTA’s petition. Instead, there was a long period of silence. Some would call it a gestational period, in which the FCC’s silence and inaction was intentional and intended to allow VoIP to develop technologically and commercially in an incubated and insulated environment.

By 2001, a very Internet-friendly face showed up at the FCC in the form of Chairman Michael Powell. Under Powell, the VoIP gestational period continued. In 2004, the Commission took its first official action regarding VoIP when it halted the Minnesota Public Utilities Commission’s efforts to regulate Vonage (News - Alert). Indeed, almost simultaneously, the FCC announced the establishment of its IP-Enabled Services Rulemaking proceeding, which, at the time, Chairman Powell said was going to be the venue for making all future decisions on what, how and to what extent VoIP services would be regulated.

The 2004 Vonage Preemption Order was widely hailed at the time as the shield long sought by VoIP providers — the shield from being regulated by 50 different states and taxed by 50 states and countless localities. The euphoria quickly wore off when Powell was followed by Kevin Martin, an FCC chairman who unabashedly demonstrated a very incumbent-friendly tilt. And, there is nothing the incumbents fear more than technological advancement. In its waning days as a stand-alone long distance provider, AT&T (News - Alert) fired off a volley of FCC petitions aimed at separating VoIP from traditional telephone services. However, as AT&T’s days were numbered, so too were the days of a supposedly regulation and tax-free VoIP industry.

As the Bell System re-monopolized, the lines between traditional circuit switched telephony and IP-based telephony began to blur. No decision is more important in the evaporation of this line than the FCC’s April 2004 AT&T Phone (News - Alert) to Phone “IP-in-the-Middle” Order because the decision impacted not just retail service providers, but the entire supply chain that is involved in the delivery of VoIP telephony services.

This may not have been the FCC’s intent when it issued the its IP-in-the Middle Order, but it is funny how precedent can be expanded when there is a $7 billion dollar fund to feed. Essentially, in the IP-in-the-Middle Order, the Commission found that “an interexchange service that: (1) uses ordinary customer premises equipment (“CPE”) with no enhanced functionality; (2) originates and terminates on the public switched telephone network (“PSTN”); and (3) undergoes no net protocol conversion and provides no enhanced functionality to end users due to the provider’s use of IP technology” is a telecommunications service. The impact of the FCC’s decision was to ensure that Universal Service Fund obligations could and would be assessed on IP-in-the-middle communications services.

The Arrival of I-VoIP

The next round of FCC activity addressed services that did not neatly fall within the category described in IP-in-the-Middle Order. In its June 2005 VoIP 911 Order, the FCC created an entirely new category of regulated communications service — Interconnected Voice over Internet Protocol (“I-VoIP”) (see below). As a result of this decision, I-VoIP has become the poster child most communications legal practitioners rely on to differentiate between the type of IP telephony services the FCC seeks to regulate, as opposed to those it leaves untouched.

One common thread of all I-VoIP services is that they must include “off net” communications. “Off net” refers to the fourth prong of the definition; at least one end-point of a two-way communication must touch the PSTN.

Arguably, the FCC intended for its interconnected VoIP regulations to apply only to services which qualified as substantial substitutes for traditional telephony. There is one more important consideration that plays a significant role in determining whether, how, and the extent to which any particular retail “I-VoIP” service is regulated and taxed (see below for more on retail VoIP): the difference between being a fixed vs. nomadic VOIP service — which is sometimes referred to as “over the top” VoIP.

VoIP Toll

In addition to the newly created category of I-VoIP, there may exist yet another category of IP-enabled services: “VoIP Toll.” This category stems from the language included in the Universal Service Administrative Company’s (“USAC”) Instructions to Form 499-A. Specifically, the Instructions state that providers of toll service should classify their services as “VoIP Toll” on Form 499-A if those services: (1) use ordinary CPE with no enhanced functionality; (2) originate and terminate on the PSTN; and (3) undergo no net protocol conversion and provide no enhanced functionality to end- users due to the provider’s use of IP technology.

In support of this instruction, USAC cites to the FCC’s IP-in-the-Middle Order. Pursuant to USAC’s instructions, VoIP Toll is a telecommunications service. However, the FCC neither uses the phrase “VoIP Toll” anywhere in its IP-in-the Middle Order, nor does the term appear in any FCC regulation. While the three-part test cited by USAC does appear in the IP-in-the Middle Order, the language of the Order suggests that the FCC’s intent in articulating the test was to simply clarify the scope of its holding in that proceeding, i.e., services meeting the three-prong test are properly categorized as telecommunications services. The regulatory implication of USAC’s Form 499-A Instructions is unclear, as is whether USAC even has the authority to unilaterally create a new service category. With regard to VoIP Toll, there are regulatory differences depending on whether the retail service associated with the IP-in-the-Middle is phone-to-phone or computer-to-phone or computer-to-computer.

VoIP Is Not Black and White

Simply because the FCC has defined two categories of VoIP telephony services — I-VoIP and VoIP Toll — there are still different flavors of VoIP within these categories, such as the distinction between fixed vs. nomadic VoIP.

Fixed vs. nomadic

What is the difference between fixed VoIP and nomadic VoIP?

Fixed VoIP — Only permits a subscriber to make calls from a fixed address. Fixed VoIP is ordinarily provided over a private communications network rather than the Internet. Because the origination or termination point of a fixed VoIP call can be readily identified, many of the regulatory and taxation pitfalls discussed in this presentation are minimized (or outright inapplicable to) fixed VoIP service.

NomadicVoIP — Enables a subscriber to access the Internet to make a call from any broadband internet connection. Because a call may originate from, or terminate to, any location, the FCC has held that it would be impractical, if not impossible, to separate the intrastate portion of VoIP service from the interstate portion and state regulation would conflict with federal rules and policies.

Regulatory implications

Each nuance carries significance not only at the federal level, with respect to FCC fees, but as we will discuss in future installments, there is even greater significance at the state level, primarily because since the Vonage Preemption Order, the FCC has done very little to prevent states from creeping into the taxation and even regulation of VoIP.

Next month, we will examine regulation of VoIP.

Jonathan S. Marashlian is the head of the regulatory practice of Helein & Marashlian, LLC, The CommLaw Group. To read more of his articles, please visit please visit his columnist page.

Edited by Michael Dinan

Internet Telephony Magazine

Click here to read latest issue

Internet Telephony Magazine

Click here to read latest issue CUSTOMER

CUSTOMER  Cloud Computing Magazine

Click here to read latest issue

Cloud Computing Magazine

Click here to read latest issue IoT EVOLUTION MAGAZINE

IoT EVOLUTION MAGAZINE