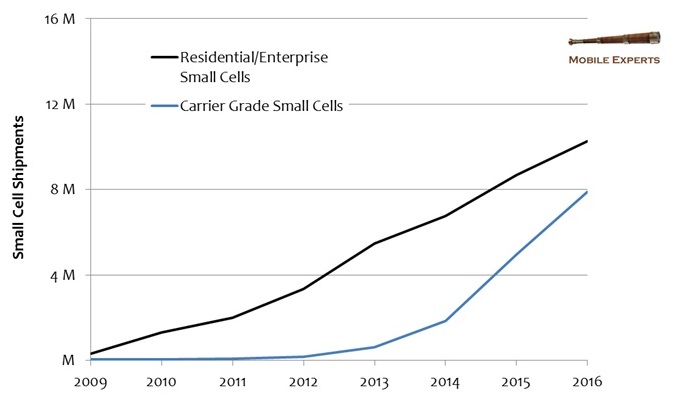

The number of small cells in service has surpassed six million (6,069,224), according to Informa Telecoms & Media. More than 80 percent of those deployments are residential or possibly business femtocells, used to shift air access to a local fixed network location.

Assuming the balance of 20 percent are carrier small cells used in indoor, outdoor or other public locations, there could be about 1.2 million carrier small cells in operation.

Informa says there are 45 small-cell deployments in place by nine of the top 10 operators by revenue globally. Sprint (News  - Alert), Telefónica O2, Orange UK, and Bouygues Telecom are among them.

- Alert), Telefónica O2, Orange UK, and Bouygues Telecom are among them.

Perhaps the most interesting new development is the emergence of new wholesale small cell services. As some businesses supply macrocell tower real estate, some new providers are, planning to build wholesale “small cell” networks that will sell service to mobile operators who want to reinforce their coverage at certain usage hot spots around a city.

The report called such businesses “Small Cell as a Service.” Virgin Media (News - Alert) is among the firms planning to launch such a service. Colt Telecom is already in trials with a major European operator as well, Informa says.

Also, Cloudberry Mobile (Europe) and ClearSky (United States) have launched their own small cell wholesale offerings.

“We believe femtocells can be deployed by rural carriers to cost effectively address a number of operational challenges including reducing roaming costs by filling coverage gaps in their own markets, offloading data traffic from their core networks, and eliminating poor coverage within their subscribers’ residences,” said Tony Tagliareni, ClearSky Technologies chief sales & marketing officer.

“We offer ‘Small Cell As a Service’, where we host a small cell gateway and remotely operate all the logistics of rolling out residential and enterprise small cells,” says Geir Ove Jenssen, Cloudberry Mobile CTO.

“Our focus is on the residential and enterprise markets,” he says.”Our target customers are the smaller network operators in European countries, typically the 3rd or 4th, who don't have such large network assets as their larger competitors.”

By way of comparison, global macrocells are estimated at 5,925,974. At least initially, consumer femtocells have represented most of the deployments. But carrier small cells will catch up after about 2014, according to Joe Madden, Mobile Experts principal.

Edited by Brooke Neuman

Internet Telephony Magazine

Click here to read latest issue

Internet Telephony Magazine

Click here to read latest issue CUSTOMER

CUSTOMER  Cloud Computing Magazine

Click here to read latest issue

Cloud Computing Magazine

Click here to read latest issue IoT EVOLUTION MAGAZINE

IoT EVOLUTION MAGAZINE