Understanding why customers choose products and services over a competitor and stay or switch is to put it mildly, truly “mission critical.” And, in the rough and tumble world of mobile services, where churn rates are historically high, having up-to-date insights into consumer attitudes that drive their behavior about who they want as a services provider is particularly crucial. It is why Nokia’s (News - Alert) Acquisition and Retention Study is always highly anticipated.

The wait is over. The Nokia 2016 Acquisition and Retention Study, the tenth undertaken, has been released. The reason this one should command even more than the usual attention is that there are some notable changes in the market that need to be recognized by mobile service providers as they look to create sustainable differentiated value and increase customer loyalty.

Another reason the study is one to spend some time with is that Nokia surveyed more than 20,000 mobile phone users in mature and transition markets. In addition it conducted telephone interviews with 140 consumers and 28 operators, and used bespoke research to contextualize responses.

This year’s study looks at four factors that impact mobile customer loyalty: cost and billing, network quality, customer care and service and device portfolio. Interestingly, while one would not suspect that results would not show significant deviations from previous years, the 2016 one found five factors that notably changed in the last two years.

- Global mobile subscribers, particularly in mature markets, want more transparency when it comes to contract terms, rate structures and data over run fees. While price is still the most important factor when it comes to customer acquisition and retention, the study reported calling plans and rate structures are 14 percent more important to respondents than they were in 2014. The report found customers, confused by different packages, will often choose easy-to-understand terms and conditions over price.

- Respondents say customer care has 60 percent more impact on their loyalty than it did in 2014. This is the biggest change in our study. Respondents say better general services, self-service capabilities and effective complaint handling are increasingly important to them. Customer care is now basically on par with network quality as a deciding factor to stay with a mobile provider.

- Networks are getting better in mature markets but there is work to do in transition markets. Consumers in mature markets report a 13 percentage-point improvement in their satisfaction with Internet connection quality vs. 2014 while transition markets report a slight decline.

- Mobile security is a growing issue: 90 percent of customers in mature markets and 94 percent in transition markets worry about mobile security. Globally 47 percent of respondents would change operators if they suffered a security breach - that’s a 7 percentage-point increase from 2014.

- Consumer expectations about IoT are growing. 56 percent of respondents in mature markets and 82 percent in transition markets would like to control at least one device via their mobile phone or tablet.

Bhaskar Gorti, Applications & Analytics president at Nokia, said: “We can see the marketing battles to acquire mobile subscribers are fierce. What we don’t see as well is the work operators do every day to retain customers. Our study shows how important that work is – and also how challenging it is as customers, attached to their phones, demand higher levels of service.”

The study also revealed notable trends in the areas of valued-added services, connected devices, voice and messaging, bundled services and more. Nokia cites the following findings of interest on these fronts:

- The importance of a mobile provider’s service and device portfolio has a 10 percent impact on a customer acquisition, up from 6 percent in 2014.

- 4G services could play a bigger role in customer acquisition and retention. Respondents using 4G were 38 percent more likely to be satisfied with their data speed and 24 percent more likely to be satisfied with data consistency than earlier-generation technology. Yet in the past year, only 38 percent of respondents signed up for 4G. Almost a third of the respondents did not know if their operator offered the technology.

- The study reported different uses of applications in mature and transition markets: 87 percent of consumers in transition markets use messaging applications compared to 46 percent in mature markets

- 38 percent of respondents said they would be willing to receive advertisements on their mobile devices in exchange for rewards.

- 68 percent of respondents said they would leave an operator over network quality issues. In particular, the speed and consistency of Internet connection matters more for keeping customers loyal than either voice quality or network coverage.

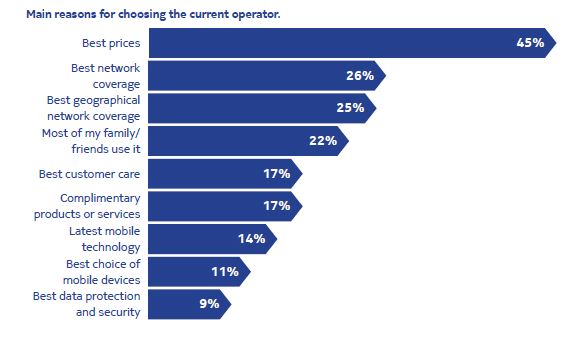

The two pullouts from the above that caught my attention were the increased weight given by consumers to improved customer experiences and security. The needle movement is important, and it needs to be put in the context of the reasons customers gave for selecting their current operator in the first place.

Source (News - Alert): The Nokia 2016 Acquisition and Retention Study

With various research studies from several sources indicating that our smart devices have now surpassed others as our platforms for interaction of all types, the lesson from the study about the need for operators to be more transparent, responsive and provide a secure environment may seem obvious, but that also deserve to become cause for action and not just observation. As we know from the churn rates, it is a very fickle and increasingly sophisticated consumer out there and fortunes can change rapidly.

Edited by Stefania Viscusi

Internet Telephony Magazine

Click here to read latest issue

Internet Telephony Magazine

Click here to read latest issue CUSTOMER

CUSTOMER  Cloud Computing Magazine

Click here to read latest issue

Cloud Computing Magazine

Click here to read latest issue IoT EVOLUTION MAGAZINE

IoT EVOLUTION MAGAZINE